What does it mean? That we have several options available where we can create our digital accounts! And what is an online bank? In layman’s terms, it is a bank account that’s only available on the web or on your phone. That is to say, all the support and the operations are done via the internet or phone calls, so you don’t ever need to go to a banking agency! Opening your account, transferring your money, reaching the support… everything is on the internet. Most of these banks don’t even charge a monthly maintenance fee or fees for withdrawals and wire transfers, except in a few cases. And in this article not only will we list the best online banks, we will also give you a few tips so you stay clear of possible scams and enjoy all this account model has to offer! So grab your favorite note taking app – some of which we’ve talked about in our article about the best free Android apps – and start taking notes about the best online bank for you! Tip: If you need a complimentary income, check out our tips about the best remote work websites, learn how to make money clicking ads, and check out the best apps to make money!

Banks

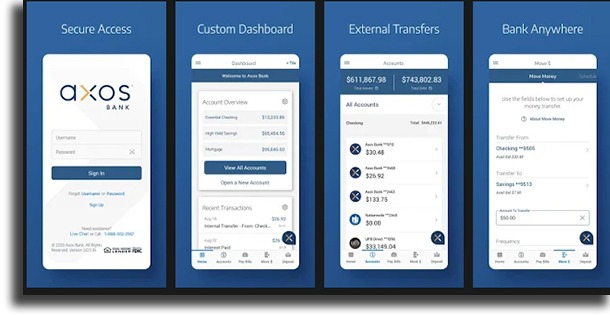

1. Axos Bank

Axos Bank is one of the most complete and well-rounded of the online banks, and for that reason it is also one of the best. While it does have a minimum deposit requirement, it is reasonable, and one of the biggest upsides of this bank is that it has over 90 thousand ATMs around the US, and you get reimbursed for any withdrawal for out-of-network ATMs! Other than that, it offers constant 24/7 support, including during all the biggest holidays, via phone and chat messaging! Just to top off on the accessibility side, it even has a live chat feature on the website. Of course, a online bank needs to do well when it comes to the apps, and it does, since it is one of the best you can find. Overall, you’ll have a hard time finding a better general bank. To start using it, simply go to the official website!

2. Ally Bank

Another one of the best online banks is Ally Bank, one that has gained its spot on our list due to the phenomenal customer service. You can reach the support via phone 24/7, you can talk on the live chat, send email tickets, and even regular mail tickets. Other than that, it has some really competitive rates for its products, including really low fees, no maintenance fees, and not even a minimum balance requirement. It also offers an extensive ATM network and they promise to reimburse up to 10 USD per statement cycle should you use an out-of-network ATM. To learn more about a great bank, follow this link.

3. Chime

Chime is a great online bank for those who are in need of a tool to automatically save every month. Its Save When You Spend feature will let you save small amounts every time you make a transaction by rounding all purchases up to the nearest dollar and putting the amount in your Savings Account. There’s also a feature called Save When I Get Paid which offers an option where you can set up a recurring transfer of 10% of your paycheck whenever you get paid, as well as of any money that gets deposited into your account. Other than the great saving tools, it has some good rates for savings, small fees, and no minimum requirements. Its mobile app is one of the best around, but the largest downside is that the support is not available 24/7. Learn more by following this link.

4. Varo Bank

Another absolutely great option for those who want a savings account, Varo Bank is one of the best online banks. It will pay you 0.81% APY on all of your balances, and depending on whether or not you meed the necessary requirements, you can receive up to 2.80% APY! Varo does not, as is the norm, charge you any monthly fees and it doesn’t have a minimum balance requirement for the checking or the saving account. It offers a large ATM network and some good saving tools, and if you get paid via direct deposit, you might even receive your paycheck 2 days early. Its mobile app is great, and the customer service is one of the most well-rated around. You can reach it 24/7. Learn more about Varo by following this link!

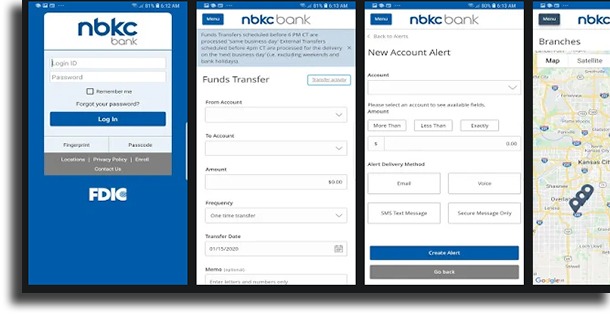

5. nbkc bank

nbkc bank is an alternative that offers one of the simplest solutions around: here, you’ll have access to an all-in-one account in the Everything Account, which includes both savings and checking accounts! Through it, you’ll be able to spend, save, and pay all your bills with ease. Its ATM network is quite extensive, with 34 thousand ATMS available, and if you withdraw from an out-of-network ATM you can get reimbursed up to 12 USd a month. If what you want is a bank with almost no fees whatsoever, this is the best option. You will be free of monthly maintenance fees, overdraft fees, minimum balance fees, and even foreign transaction fees! You can get in contact with the customer support 24/7 via live chat, phone, or email. To learn more about nbkc bank, follow this link!

6. Quontic Bank

One of the best online banks for those who are really into cashback, Quontic Bank offers up to 1.50% cashback on debit card transactions that qualify. It certainly matches up very nicely when used along the best cashback apps! Something extremely nice is that it has a separate high interest checking account for anyone who can meet the admittedly somewhat high requirements which pays 1.01% APY. Its minimum deposit requirements are also really low. Other than that, you’ll have access to over 90 thousand ATMs across the US where you don’t have to pay anything to withdraw. Unfortunately, the customer service is lacking in the sense that it is not available 24/7. To see more about Quontic, follow this link!

7. Simple

Another great bank if you need specific budgeting and saving tools is Simple. It has a tool called Safe-to-spend that helps its customers track their spendings by automatically determining the necessary funds to pay your bills and expenses (of course, as long as you type in the amounts!). It has a few different account models, including the Simple Account, which is the more standard one, the Protected Goals Account, which is its take on a savings account, and even a shared checking account. To manage your account, you can either download its great mobile app or log into the website. Other than that, it’s very light on fees, so there’s no monthly fees, no ATM fees, and no overdraft fees. Go to the official website to learn more.

8. BBVA Online Checking

BBV Online Checking is a complete bank that offers a wide range of deposit accounts and lines of credit both for individuals and for businesses. You don’t have to pay for withdrawals on its over 64 thousand ATMs, there are no monthly fees, and more. You can also earn interest on your savings account that has a low minimum deposit of 25 USD, without any service charges. Beyond that, it offers you credit cards, personal loans, home loans, auto loans, and even investment options. See everything about BBVA on the official website.

9. Salem Five Direct

Salem Five Direct is among the best online banks in part due to its amazing insurance for high-earners, since it combines the FDIC insurance of up to 250 thousand USD, with the Massachusetts Depositors Insurance Fund (DIF), for those above this amount. Other than that it is free of most charges, so you don’t have to worry about monthly fees or even out-of-network ATM fees. The only two you do have to keep in mind is the 35 USD overdraft fee, and that third-party ATMs will cost you, but the bank reimburses up to 15 USD a month. Its mobile app is one of the highest rated of our list, it offers decent APYs for your savings, and you can reach the support via live chat, online messaging, email, and phone 24/7. Go to the official website right now to see more about Salem Five Direct!

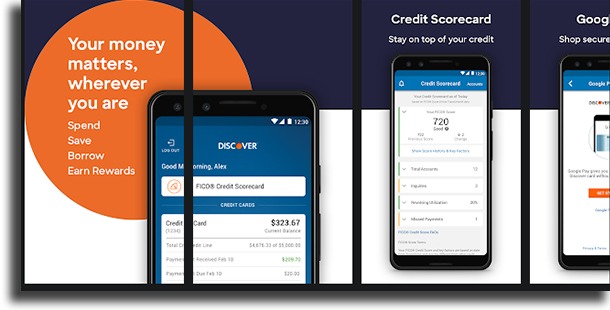

10. Discover Bank

The last of the best online banks in our list is Discover Bank, one that does its best to keep all fees to the minimum. You will be free of monthly maintenance fees, of insufficient fees, out-of-network ATM fees, stop payment order fees, excessive withdrawal fees, or anything else! It is also a great option if you want cashback, since it gives you 1% back for up to 3000 USD spend on qualifying debit card purchases every month. Its ATM network is really quite extensive, the savings account offers a great APY (but you don’t earn interest on the checking account), and the bank offers many other services. Of course, since it is an online bank, it does have a pretty good mobile app with amazing ratings. Other than that, you also have access to 24/7 customer service. Follow this link to learn more about Discover Bank!

Tips

1. Check out the services they offer

Even though most offer a lot of services in common, not all of the best online banks will have all you need covered. For that reason, it is always important to check what services and features each and every one of them offers to their clients It’s a good idea to use a note-taking app or a notepad to create a full list of what each of the online banks offers to you, and the fees you’ll have to pay. With that in hands, it gets much easier to review these services and to choose one!

2. Review how much each one of them costs

Some (most?) of these online banks offer some great services such as free and unlimited withdrawals and transfers. Others, however, are more limiting, and charge after a while, charge for out-of-network ATMs, and some other things. It’s important to always pay attention to these details, since they’re an important factor when it comes to determining which one of the best online banks suits you. For that reason, note down how much each transaction costs and how many times you can do it before having to pay.

3. Know what are your needs

There’s no point in adhering to an online bank that charges you no fees whatsoever if it doesn’t fill your neds. If you’re an investor, for example, there’s no point in going for an account without investing options. Do also check out if you will need to get loans or insurances. On the other hand, if all you need is to withdraw and do wire transfers without needing to pay for any fees, you won’t need a really complete online bank.

4. Check out the bank’s scores on websites

One of the best and most trustworthy bank review websites, Bankrate is a pretty good way for you to have an idea of how good is the service offered by the best online banks (and many others). Before opening your account, go to Bankrate by following this link and look for the name of your desired bank. Check the rating and the review to see just how good it is and how well it will really suit you.

5. Don’t close your regular account

One of the biggest temptations when opening your online account is closing your regular one right after, but you shouldn’t do so at first. Nowadays, there are a really large number of new online banks, and some of them might not really last that long. For that reason, stay at least a year with both accounts opened before deciding on whether you should close off your regular one or not. Get a good grasp on how the support works, what are the features and if they work well, and only then, if the online bank offers a better service, close your regular account.

Which one of the best online banks is your personal favorite?

Let us know in the comments if you liked our guide, and don’t forget to also check out the best free iPhone apps, the best ways to make money online, learn how to fix the most common Android problems, and learn what to do about a dead iPhone!